Massive Loss! Net Loss of 1.5 Trillion Yen: A Japanese Bank Suffers Huge Losses from Misjudging Rate Cuts and Investing in Western Bonds

Buying Bonds to the Point of “Owing Debt”

Recently, Norinchukin Bank, Japan’s fifth-largest bank, announced plans to sell over 10 trillion yen (approximately $63 billion) in U.S. Treasuries and European sovereign bonds to cover massive unrealized losses.

Norinchukin Bank misjudged the intensity and duration of the Federal Reserve’s rate hike cycle, leading to a continuous decline in the value of the foreign bonds it had purchased at high prices. The bank’s failure to implement effective risk controls during this period resulted in a sharp increase in unrealized losses.

Norinchukin expects that, with the bond sales, its net loss for the fiscal year ending March 2025 will rise to 1.7 trillion yen, more than triple the loss during the 2008 financial crisis (570 billion yen).

Norinchukin holds 20% of Japan’s foreign bonds, and as it begins to offload U.S. Treasuries on a large scale, the ripple effects could quickly spread to other institutions and retail investors. Given that Japan is the largest holder of U.S. debt, will local buyers’ sell-offs trigger a “fire sale” of U.S. Treasuries?

Contrarian Accumulation Leads to Massive Losses

Unlike major general banks such as Mitsubishi, Norinchukin’s loan business is much smaller than its competitors, and it does not have an investment banking business. It primarily relies on its securities investment portfolio to generate profits, with its current asset management scale at $840 billion.

Thanks to Japan’s negative interest rate environment, Norinchukin could finance at extremely low costs and then invest the raised funds in U.S. Treasuries.

According to the Bank of Japan, as of the end of March, the scale of foreign debt held by deposit-taking financial institutions reached 117 trillion yen, with Norinchukin accounting for about 20% of that share. Besides investing in bonds, Norinchukin is also a major player in global collateralized loan obligations (CLOs).

However, even such a professional player has repeatedly made significant mistakes.

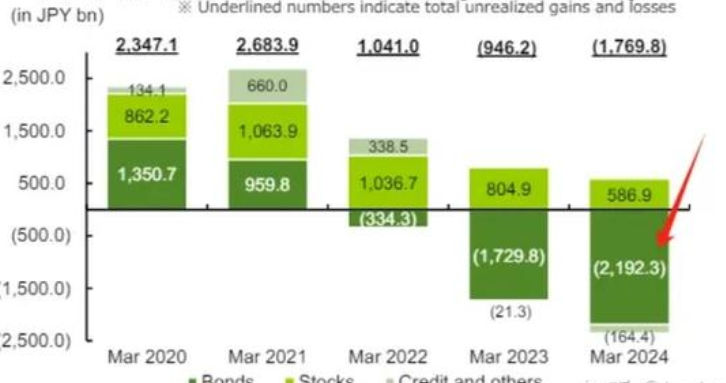

According to documents released by Norinchukin last month, as of March this year, the bank’s bond holdings of 31.3 trillion yen accounted for about 56% of its overall investment portfolio.

Moreover, looking at the holdings over the past three years, Norinchukin reduced its bond holdings by about a quarter in 2023, mainly to mitigate the pressure from the Federal Reserve’s rate hikes.

However, by the end of March this year, Norinchukin had replenished its bond holdings to 31.3 trillion yen, indicating that it was betting on the U.S. and Europe cutting rates soon.

At the beginning of the year, the market optimistically believed that the Federal Reserve would start cutting rates as early as March, with 5-6 rate cuts throughout the year. Reality, however, dealt a heavy blow to every optimist, as economic data repeatedly fell short of expectations, causing the Fed to delay rate cuts.

With heavy positions in U.S. Treasuries, Norinchukin’s losses grew over time, reaching 2.19 trillion yen in bond losses and expanding the net loss to 1.76 trillion yen by March.

Selling Bonds May Trigger a Chain Reaction

Last month, the bank announced a comprehensive plan to adjust its investment portfolio, and just a few days ago, it finally announced the need to “cut losses” on its bond portfolio.

Norinchukin CEO Kazuto Oku stated in a media interview:

“We plan to sell 10 trillion yen ($63 billion) or more of low-interest foreign bonds. The bank acknowledges the need to significantly change its portfolio management to reduce unrealized bond losses, which totaled about 2.2 trillion yen as of the end of March.”

Additionally, the Bank of Japan’s first rate hike in decades this March also dealt a double blow to these banks holding overseas bonds.

As is well known, Japan is the largest holder of U.S. debt. According to U.S. Treasury data, as of March, Japanese investors held $1.18 trillion in U.S. Treasuries, the largest share among foreign investors.

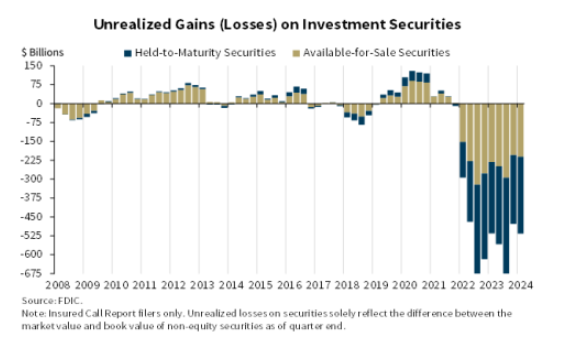

On the other hand, a report from the U.S. Federal Deposit Insurance Corporation (FDIC) shows that U.S. banks’ unrealized losses in the first quarter amounted to $516.5 billion, an increase from the previous quarter.

If the Federal Reserve continues to make decisions below market expectations in the coming months, it could lead to more banks “blowing up,” triggering a series of chain reactions.

Post time: Jun-21-2024