Each Mortgage Loses $645! Banks: This is Good News!

Firstly, thanks to the market improvement, Marina Walsh, MBA’s Vice President of Industry Analysis, stated in a press release that although there were consecutive losses in the first quarter of 2024, the losses were less than in the previous two quarters.

Loan revenues exceeded historical averages, while loan costs decreased, resulting in a nearly 50 basis point increase in net profit during the quarter.

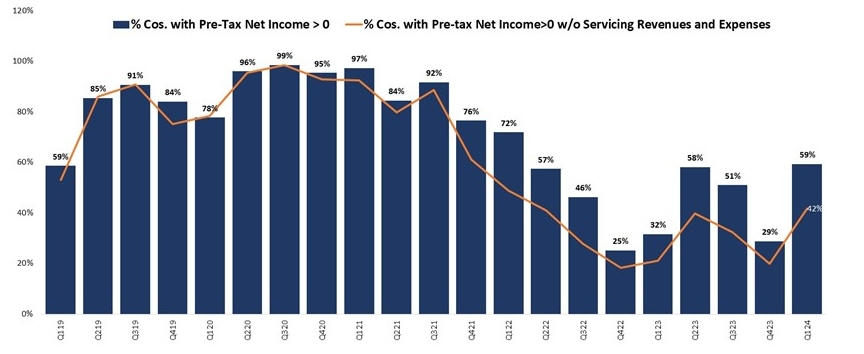

Secondly, Walsh added that 59% of mortgage companies were profitable in the first quarter, the highest level in eight quarters, significantly up from 29% in the fourth quarter of 2023. Before this, the industry had experienced eight consecutive quarters of losses.The improved financial performance of retail lenders aligns with a more stable secondary mortgage market. Since peaking in the fall of 2023, spreads have narrowed. Additionally, although still below pre-pandemic levels, housing inventory has increased from last year’s lows.Analysis of Report Content

1. Increase in Loan Volume

The MBA report shows that the average loan volume per company increased from $359 million in the previous quarter to $384 million in the first quarter. The average number of loans per company also increased from 1,170 to 1,193.

2. Growth in RevenueWalsh’s analysis found that loan revenue in the first quarter increased from 334 basis points in the previous quarter to 371 basis points, an increase of approximately 10 percentage points. On a per-loan basis, it increased from $10,376 in the fourth quarter of 2023 to $11,947 in the first quarter.3. Changes in Loan Balance and Costs

The average loan balance for first mortgages increased from $336,757 in the previous quarter to $345,761. Total loan costs decreased from 407 basis points in the previous quarter to 395 basis points, but the cost per loan increased from $12,485 to $12,593.

In summary, from the perspective of loan revenue and costs, although positive earnings have not yet been achieved, the market has shown significant improvement.

Future Outlook and Predictions

MBA Chief Economist Mike Fratantoni expects a total loan volume of $1.8 trillion this year, with mortgage rates expected to reach 6.5% or even lower by the end of the year.

He predicts a significant rebound in the mortgage market over the next two years. He forecasts a loan volume of $2 trillion in 2025 and $2.28 trillion in 2026. He expects mortgage rates to decrease to 5.9% in 2025 and further to 5.7% in 2026.

Post time: May-24-2024