CPI Exceeds Expectations: Two Facts, One Truth

09/27/2022

Inflation peaks but hardly declines

Last Tuesday, the Labor Department released data showing that the CPI rose 8.3% in August from a year earlier, while expectations were for 8.1%.

This is the last release of inflation data before this month’s scheduled rate hike, which undoubtedly generated the most interest in global markets last week, when Wall Street was hit by a “Black Tuesday” double whammy in stocks and bonds.

Compared to inflation rate 8.5% in July, CPI in August is only 0.2 percentage points higher than the market expectations which has been in a downward trend for two consecutive months. Many people may have doubts why the financial markets are still so nervous.

You know, the day of the data release is the biggest decline in two years, U.S. bond yields soared, two-year U.S. bond yields even to a fifteen-year high.

Is this amazing market volatility only due to the “insignificant” expected difference of 0.2%?

The relative optimism in the earlier market forecasts was due to the sharp drop of energy prices in August, especially gasoline prices, which is also reflected in the latest inflation data.

However, these data also show that the supply shock triggered by the pandemic has turned into full-blown inflation and has not declined as the market expected.

The seemingly insignificant expectation gap of 0.2 percentage points may conceal a much more serious situation than the figures reflect.

Rate hike expectations becomes high again

In fact, energy prices are almost the only good news in this inflation report.

Beyond that, prices are rising in almost every major category, including food, rents, clothing, furniture, cars, health care and more.

And as we all know, energy prices have always been known for their high volatility, and there’s no guarantee that oil prices, which plummeted in August, will not rise again in the months ahead.

If you look closely at the development of this inflation data in the full “fall” in the partial data, it should not be difficult to understand why the market is even suddenly betting on a 100 basis point increase.

Remember, the Fed has raised rates by a total of 225 basis points since March, but price increases seem to show no signs of slowing.

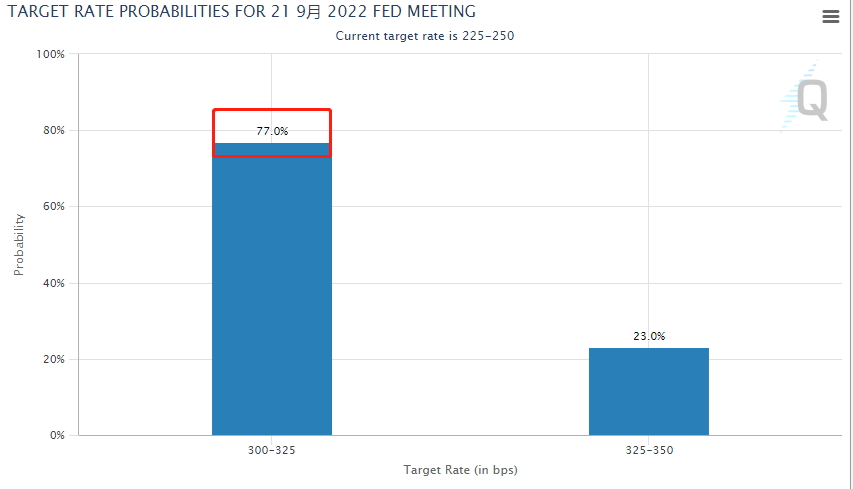

Currently, the CME Group FedWatch tool shows that the probability of a 75 basis point Fed rate hike in September has increased to 77% and the probability of a 100 basis point rate hike is at 23%.

Image source: https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

The market is beginning to understand that the Fed’s tightening policy will not change, at least until the end of the year, because U.S. equities will always face the political trend of suppression.

Subsequent rate hike path.

The Fed’s 75 basis point rate hike at the September 21 meeting was basically certain to happen.

With high inflation underpinned by strong economic data, Federal Reserve officials have taken a stand to fight inflation and prevent it from rising again.

The market now generally expects the federal funds rate to rise above 4% to 4.25% by the end of the year, which means a total of at least 150 basis points of rate hikes in the remaining three meetings this year.

This assumes a 75 basis point rate hike in September, then at least 50 basis points in November, and at least 25 basis points in December.

If the policy rate is above 4%, it will be held in that “restrictive range” for a long time, as Powell has said before.

In other words, mortgage rates will remain high for quite some time! Those in need of a mortgage should seize the opportunity before the rate hike occurs.

Statement: This article was edited by AAA LENDINGS; some of the footage was taken from the Internet, the position of the site is not represented and may not be reprinted without permission. There are risks in the market and investment should be cautious. This article does not constitute personal investment advice, nor does it take into account the specific investment objectives, financial situation or needs of individual users. Users should consider whether any opinions, opinions or conclusions contained herein are appropriate to their particular situation. Invest accordingly at your own risk.

Post time: Sep-27-2022