CalHFA Dream for All Returns Strongly!

After much anticipation, on January 18th, the California Housing Finance Agency announced the strong return of the CalHFA Dream For All program, with a total allocation of $220 million. This is set to create significant waves in the subsidy product market in 2024. It’s time to act and explore the benefits of this program and how it differs from previous years.

1. Widespread Benefits for Homebuyers

The CalHFA Dream for All provides up to $150,000 or 20% of the home purchase price or appraisal value, whichever is lower. With a subsidy cap of $150,000, it is expected to benefit at least 1,466 homebuyers. The eligibility requirements for homebuyers are as follows:

- Each borrower must be a first-time homebuyer.

- At least one borrower must be a current resident of California.

- At least one borrower is a first-generation homebuyer.

Many may be unfamiliar with the term “first-generation homebuyer.” Don’t worry, let’s demystify it.

Key Point: Definition of a First-Generation Homebuyer

- A borrower who has not owned property in the U.S., held property rights, or been listed on a mortgage loan in the past seven years, and:

- To the best of the homebuyer’s knowledge, their biological or adoptive parents currently do not own any property rights in the U.S., or if deceased, did not own any property rights in the U.S. at the time of their death. Or;

- Individuals who have been placed in foster care or institutional care (large children’s residences cared for by non-relatives).

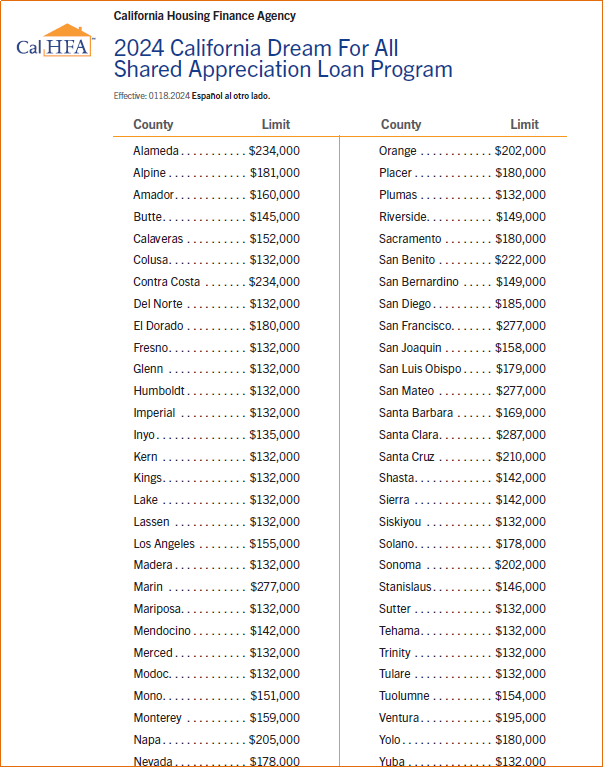

- Income must be below or equal to the income limits of CalHFA Dream For All. The 2024 county income limits are detailed in the following figure..

2. Application Process

- Process Update:

This year, the California Housing Finance Agency will launch a separate pre-registration system, and only those who pre-register will be eligible to proceed to the next step. The specific registration process has not yet been announced, so stay tuned for our latest news.

- Method of Obtaining Homebuying Qualifications:

To ensure fairness, this round of subsidies introduces a “new gameplay.” The California Housing Finance Agency will issue a lottery number to each eligible applicant, randomly selecting guests who meet the criteria to receive the subsidy. This replaces the first-come, first-served approach of last year.

AAA LENDINGS was fortunate to have completed some Dream for All subsidy loans last year. Although the requirements and processes have changed this year, they are largely similar. Click this link to view! Stay tuned to us, and we will bring you the latest news on the Dream for All subsidy program as soon as possible.

This summary provides an overview of the CalHFA Dream for All program’s return in 2024, highlighting the key features and changes from previous years.

Post time: Jan-27-2024