A Financial Revolution: The Advantages of No Doc No Credit Product

In the realm of home financing, No Doc No Credit mortgage products are a testament to the industry’s innovation and adaptability, especially significant for those to whom the traditional credit reporting system does not do justice. This mortgage type is not merely a financial product but a beacon of hope for many prospective homeowners.

The ‘No Credit Report’ Advantage

Breaking the Credit Barrier

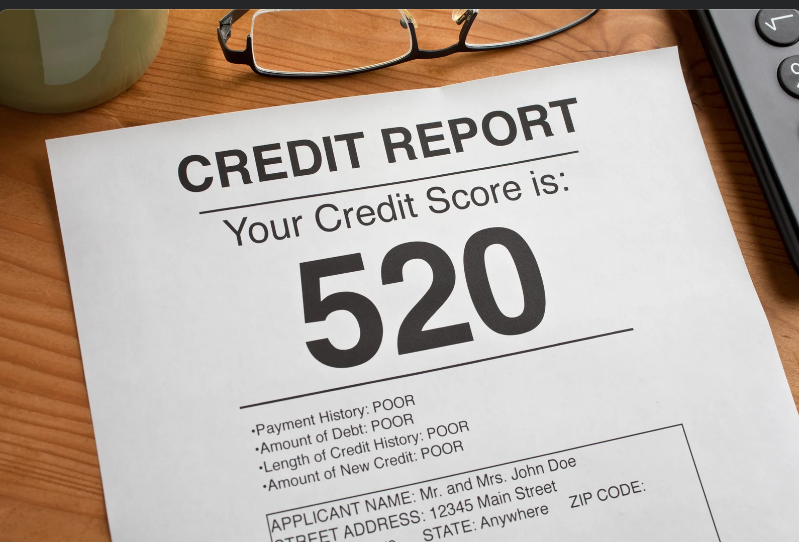

A credit report is often seen as a financial mirror reflecting years of one’s fiscal behavior. Yet, for some, this reflection is not a true representation of their financial prowess or potential. Here is where No Doc No Credit mortgages truly shine.

Unshackling from Credit History: Individuals who have experienced financial downturns or have non-traditional financial behaviors often find themselves at a disadvantage. The ‘No credit report’ feature liberates them, offering opportunities based on their present financial reality, not their past.

Privacy Preservation: For borrowers concerned about privacy, the no credit report aspect means one less entity scrutinizing their financial history, providing a sense of confidentiality and control over their personal information.

Financial Inclusivity

The cornerstone of No Doc No Credit mortgages is inclusivity. It extends the dream of homeownership to those who have been systematically excluded from traditional mortgage products.

Global Citizens: It’s a globalized world, and as people move across borders, their credit histories often don’t follow. These mortgages offer foreign nationals a chance to invest in property without being handicapped by a lack of local credit history.

Self-Made Success Stories: Entrepreneurs and self-employed individuals whose credit reports are not reflective of their success find a partner in these loans.

Beyond the ‘No Credit Report

The advantages of No Doc No Credit mortgages extend far beyond the absence of a credit report requirement. They embody a philosophy that appreciates the broader spectrum of financial health and recognizes a variety of income sources.

Embracing Alternative Income Verification

Bank Statement Programs: For those who can demonstrate financial stability through consistent bank deposits, No Doc No Credit loans offer a viable path to home ownership.

Asset Utilization Loans: If you have significant assets, these can be used to your advantage, even without a regular income stream.

A Diversity of Products

Stated Income Loans: Sometimes called “lie loans” in the past, today’s stated income loans have evolved. They now serve clients who can genuinely afford a mortgage but lack traditional income proof.

Investor Cash Flow Loans: For real estate investors, these loans base the approval on the cash flow of the property, not the individual’s income.

Navigating the No Doc Landscape

Knowledge is Power

Education about the specifics of No Doc No Credit mortgages is crucial. Potential borrowers should understand the terms, the potential for higher interest rates, and the rationale behind such rates—compensation for the lender’s risk in forgoing traditional credit checks.

A New Financial Ecosystem

For Lenders: This product offers a way to serve a growing segment of the market that is otherwise financially solid but underserved.

For Borrowers: It represents an opportunity to own a home, a chance that might otherwise be inaccessible.

The Economic Impact

Boosting Homeownership Rates: By providing more avenues for mortgage approval, these products can contribute to higher homeownership rates.

Stimulating the Economy: Home purchases often lead to increased spending in related sectors, thus stimulating the economy.

A Responsible Approach

Risks and Responsibilities

While focusing on the advantages, it is also essential to address the increased responsibilities placed on both the borrower and the lender. Borrowers must be financially disciplined, and lenders must practice due diligence without the safety net of credit reports.

A Balanced Perspective

Higher Stakes: The stakes are higher for both parties, necessitating a mutual understanding of the risks and rewards.

Comprehensive Assessment: Lenders may employ other risk assessment tools to ensure the borrower’s financial stability.

Conclusion: The Future of No Doc No Credit Product

The ‘No credit report’ feature of No Doc No Credit product is not a mere niche; it’s a forward-thinking solution for a diverse financial world. It is a product that has grown from the lessons of the past, designed with the flexibility to adapt to the complexities of modern financial life. As the financial landscape evolves, so too will the products that serve its diverse participants, continuing to open doors for many who seek the stability and prosperity that homeownership can provide.

Video: A Financial Revolution: The Advantages of No Doc No Credit Product

Post time: Nov-16-2023