The service PMI is significantly lower than expected, interest rate cut expectations are rising, and the market is waiting for the next signal

Service PMI fell sharply below expectations

Recently, Norinchukin Bank, Japan’s fifth-largest bank, announced plans to sell over 10 trillion yen (approximately $63 billion) in U.S. Treasuries and European sovereign bonds to cover massive unrealized losses.

One of the indicators of the economy, the services PMI (purchasing managers index) unexpectedly fell short of expectations in June, showing that the service industry shrank at the fastest rate in four years.

Data released by ISM showed that the service industry index fell to 48.8 in June, far lower than the expected 52.6, a significant decrease from 53.8 in May, and fell below the 50 dividing line between prosperity and contraction.

The data was not only lower than all economists’ forecasts, but also in sharp contrast to the pace of expansion in May, when the services PMI expanded at the fastest pace in nine months, with an index of 53.8, far exceeding expectations of 51.

Important sub-index analysis

The business activity index plummeted 11.6 points in June, the largest decline since April 2020, falling to 49.6, falling into contraction, and also hitting the lowest level since May 2020. The business activity sub-index corresponds to its factory output sub-index in the ISM manufacturing data.

The new orders index fell 6.8 points in a single month to 47.3, also falling into contraction, the first contraction since the end of 2022. Although the export orders index for the services industry was still growing, it fell 10.1 points to 51.7, indicating weak overseas demand.

A measure of material prices paid by service providers fell to a three-month low, suggesting inflation is gradually cooling. Specifically, the indicator fell to 56.3 in June from 58.1 in May.

The employment index shrank for the fifth consecutive month, falling to 46.1 in June, down 1 point from 47.1 in May.

The inventory index shows inventories shrinking at the fastest pace since October 2021. However, the inventory sentiment gauge jumped to its highest level since 2017, indicating that more businesses believe inventories are too high.

Order backlogs fell sharply in June, with the metric showing the fastest contraction since August last year.

Non-agricultural data is key

The deterioration of the service industry PMI showed a sudden and obvious reversal compared with May, which not only affected market sentiment, but also put pressure on the U.S. economic outlook.

The ISM manufacturing gauge shrank for a third consecutive month, with overall demand coming under greater pressure from high borrowing costs, cooling business investment and uneven consumer spending.

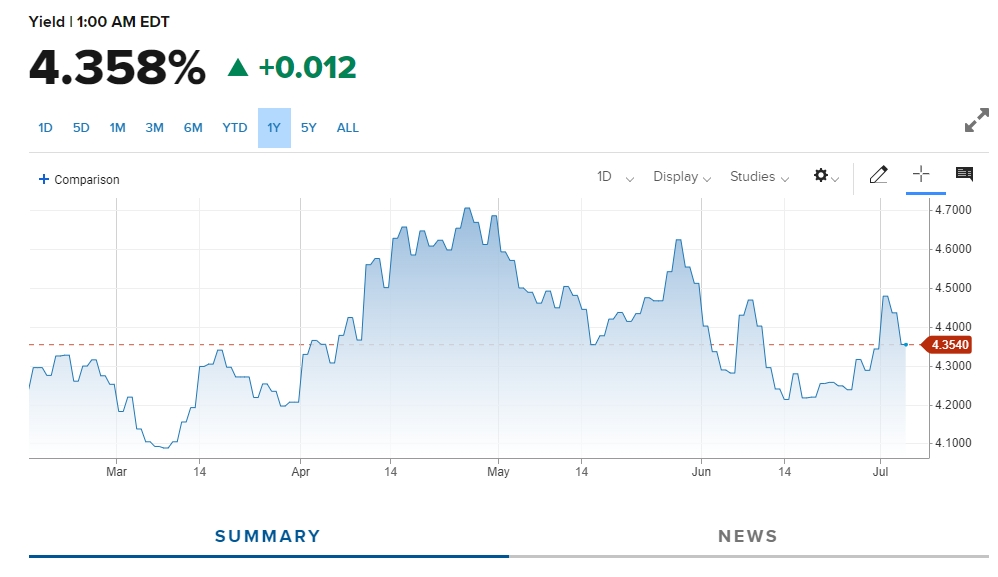

The market reacted quickly, with the 10-year Treasury yield falling significantly. It also injected a shot in the arm into the market.

In addition, non-farm payroll data for June will be released soon, and the market is waiting for the non-farm payroll data to look for clues about the Federal Reserve’s interest rate cuts. Prior to this, the stock market continued to rise this week, which also reflected the market’s optimistic tendency.

Justin, chief investment officer of St James Place, also said: “With the ISM services industry falling to 48.8 in June, the lowest level since the epidemic, and the number of jobless claims worsening, the negative data is ultimately seen as positive for the market. Feeling 9 “Month is the date that everyone is paying attention to right now.”

Post time: Jul-05-2024