What is DSCR?

Do you know how to qualify a house mortgage loan without any job information and income?

Are you not qualified with the conventional mortgage loans?

Do you know which loan program is the easiest product?

Do you want to know how to use the reduced documents to qualify a loan?

Is it very difficult for you to get a home loan in your industry?

We offer a perfect loan program to satisfy the above key factors - DSCR program. It is the most popular Non-QM product in house mortgage loans.

DSCR (Debt Service Coverage Ratio) is designed for experienced real estate investors and qualifies borrowers based on cash-flows solely from the subject property to analyze the risk degree of an investment. Today, we focus on understanding the definition of DSCR and unveiling the mystery of DSCR program from the perspective of housing mortgage investment.

News and Videos

DSCR Ratio: The Financial Health Barometer for Businesses ➡ Video

Decoding the DSCR Ratio: Your Financial Fitness Tracker ➡ Video

Maximizing Real Estate Investments with Our Innovative DSCR Loan Product ➡ Video

Unlocking Real Estate Potential with DSCR Loans: A Comprehensive Guide for Foreign Nationals ➡ Video

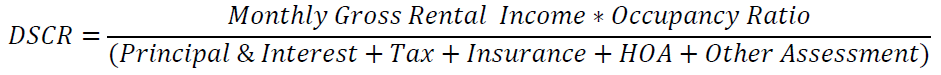

How to calculate DSCR?

For housing mortgage loans, DSCR refers to the ratio of monthly rental income of an investment property to total housing expenses. These expenses may include principal, interest, property tax, insurance, and HOA fees. Any expenses not actually incurred will be recorded as 0. The lower the ratio, the greater the risk of the loan. It can be expressed in the following:

We offer "No ratio DSCR" for our clients, which means the ratio can be down to "0". In our conventional loan products, we need to compare borrowers' income with the monthly PITI (Principal, Interest, Taxes, Insurance) plus any HOA fees and other liabilities of the mortgaged property to decide if the loan qualifies.

Benefits of DSCR

No ratio DSCR is a loan product that does not verify or require the borrower's income because it does not involve the calculation of DTI (Debt-To-Income Ratio). Importantly, the minimum DSCR (Debt Service Coverage Ratio) can be as low as 0. Even if the rental income is low, we can still do it! This is a good choice for borrowers with low income or more liabilities.This makes it a viable option even for those with low rental income, making it a good choice for borrowers with lower income or higher liabilities.

In addition, this program is also open to Foreign Nationals, especially those with F1 visas. If you're a foreign national and unable to qualify for a conventional mortgage loan, please contact us to discuss your loan scenario.