– AAA Lendings Non-QM Salary & Self-employed borrower Asset Program – True Stated Income – AAA Lendings Detail:

Overview

Use borrower’s asset to qualify, borrower’s assets need to cover at least 6-month deposits of monthly income.

Details

1) No P&L Needed;

2) No WVOE Needed;

3) 12 months reserves calculated on PI (Not PITIA other lender required);

4) Gift funds allowed;

5) Loan amount up to $2.5M;

6) Purchase & No Cash out available.

What’s this program?

• Do you know how to use asset only to qualify for you house mortgage loan?

• Were you suspended or denied by the lender for a WVOE (Written Verification of Employment) program?

• Do you have not so much asset when you want to buy your own house?

• Didn’t your employer want to provide a WVOE form or cooperate?

If you have ever met the above situation, no worries, come to us and we will introduce a Non-QM program for you—-True Stated Income. The program is familiar with the {WVOE} program, it’s designed for salaried borrowers and self-employed borrowers. Non-QM loans have little such good programs that wage earners and business owners can both apply for.

How doe this program work?

Just like what the product name, this program is qualified with asset as well. See below:

If the True Stated Income of this loan program is chosen, the borrower will only be required to provide an Asset Based Income on the Loan Application (1003). This income will be utilized to calculate qualifying debt to income ratio discussed in Section VIII of these guidelines.

Who can apply for this program?

As mentioned the above, whatever you’re salary borrower or self-employed borrower, you can apply for this program. If salary borrower, then no special documents are needed when you apply a new house mortgage loan of Non-QM with the lender. If self-employed borrower or 1099 borrower, you may need a simple CPA letter.

How doe this program work?

Just like what the product name, this program is qualified with asset as well. Unlike the other programs, we lender don’t need to prepare any special documents from the borrower. Just prepare normal bank statements when apply for your house mortgage loans, See below for your information:

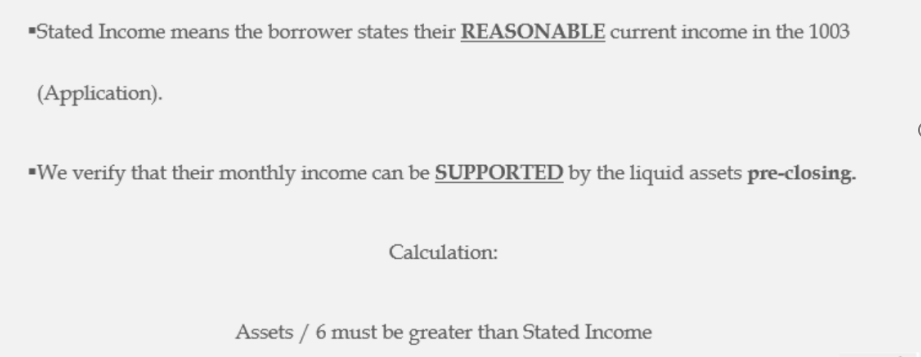

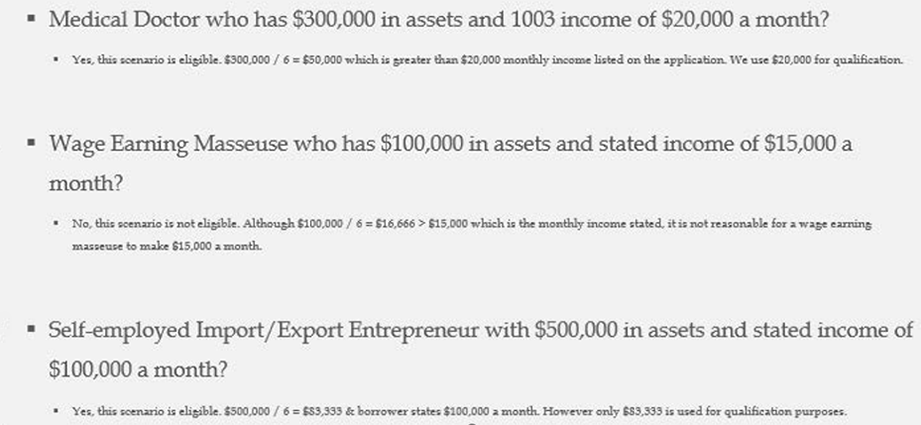

Stated Income means the borrower states their Reasonable current income in the loan application. The lender will verify borrower’s monthly income can be supported by the “Liquid” assets pre-closing.

If the True Stated Income of this loan program is chosen, the borrower will only be required to provide an Asset Based Income on the Loan Application (1003). This income will be utilized to calculate qualifying debt to income ratio discussed in Section VIII of these guidelines.

Product detail pictures:

Related Product Guide:

Planning your financial future begins with the right mortgage partner, and at AAA LENDINGS, we are committed to helping you achieve your dreams. We understand that the journey towards homeownership can be exciting but also daunting. Our seasoned professionals are more than just mortgage experts; they are your financial allies. They are available to discuss your goals, assess your financial situation, and provide personalized guidance that captures your interest. We take pride in being the guiding hand that empowers you to make informed decisions about your future. – AAA Lendings Non-QM Salary & Self-employed borrower Asset Program – True Stated Income – AAA Lendings , The product will supply to all over the world, such as: Mozambique , Azerbaijan , Honduras , Besides there are also experienced production and management , advanced production equipment to assure our quality and delivery time , our company pursues the principle of good faith, high-quality and high-efficiency. We guarantee that our company will try our best to reduce customer purchase cost, shorten the period of purchase, stable solutions quality, increase customers' satisfaction and achieve win-win situation .

In our cooperated wholesalers, this company has the best quality and reasonable price, they are our first choice.