– AAA Lendings Non-QM Salary & Self-employed borrower Asset Program – True Stated Income – AAA Lendings Detail:

Overview

Use Borrower’s 6 months deposits of monthly income to support the stated income in 1003.

Program Highlights

1) No P&L Needed;

2) No WVOE Needed;

3) 12 months reserves calculated on PI;

4) Gift funds allowed;

5) Loan amount up to $2.5M;

6) Purchase & No R/T.

What is True Stated Income?

• Do you know how to use asset only to qualify for you house mortgage loan?

• Were you suspended or denied by the lender for a WVOE (Written Verification of Employment) program?

• Does your assets have not so much when you want to buy your own house?

• Didn’t your employer want to provide a WVOE form or cooperate?

If you have ever met the above situations, the program is similar with the {WVOE} program, it’s designed for salaried borrowers and self-employed borrowers. Non-QM loans have little such good programs that wage earners and business owners can both apply for.

How does this program work?

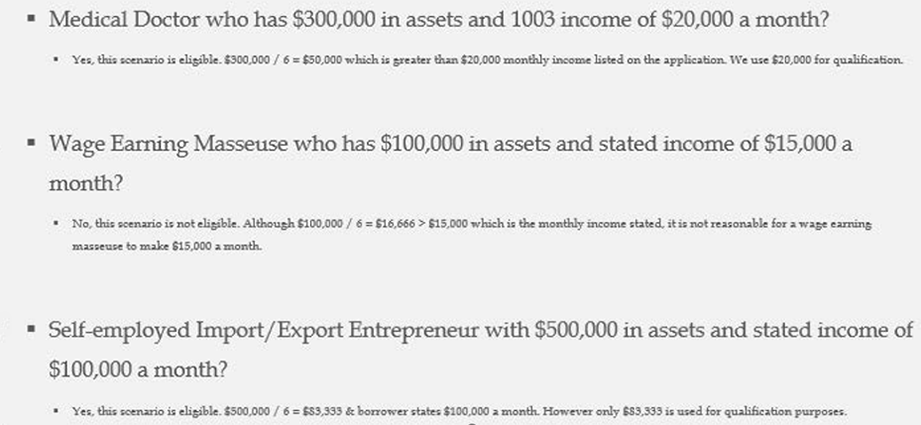

Just like the product name, this program is qualified with asset as well. See below:

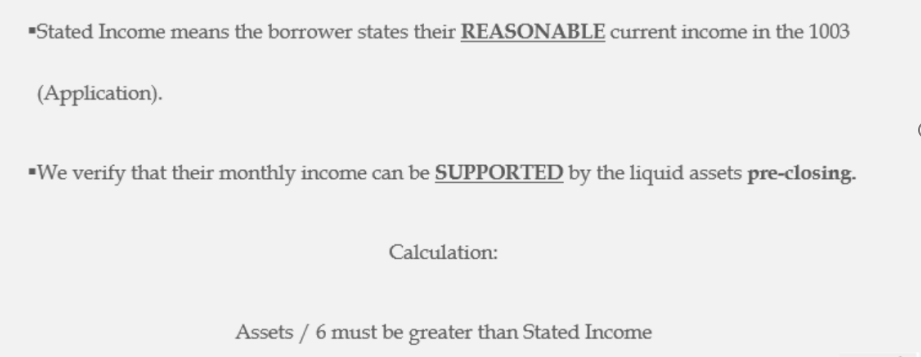

If to choose the True Stated Income program, the borrower will only be required to provide an Asset Based Income on the Loan Application (1003). This income will be utilized to calculate qualifying debt to income ratio.

Who can apply for this program?

No matter you are a salary borrower or a self-employed borrower, you can apply for this program. For salary borrowers, no special documents are needed when you apply a new house mortgage loan of Non-QM with the lender. For self-employed borrowers or 1099 borrowers, a CPA letter may required.

Product detail pictures:

Related Product Guide:

We understand that a mortgage is not just a financial transaction but a significant life decision. Our focus on customer-centricity means that we don't just consider the numbers; we consider your unique story, aspirations, and financial goals. Our mortgage experts take the time to understand your personal journey, ensuring that you receive a mortgage solution that aligns with your vision for the future. – AAA Lendings Non-QM Salary & Self-employed borrower Asset Program – True Stated Income – AAA Lendings , The product will supply to all over the world, such as: Italy , Czech Republic , Bulgaria , Our professional engineering group will always be ready to serve you for consultation and feedback. We're able to also offer you with absolutely free samples to meet your requirements. Finest efforts will likely be produced to offer you the ideal service and goods. For anyone who is thinking about our company and merchandise, be sure to contact us by sending us emails or contact us quickly. As a way to know our merchandise and firm. lot more, you can come to our factory to find out it. We'll always welcome guests from all over the world to our business to build company relations with us. Be sure to feel free to get in touch with us for business and we believe we've been intending to share the top trading practical experience with all our merchants.

We feel easy to cooperate with this company, the supplier is very responsible, thanks.There will be more in-depth cooperation.