– AAA Lendings Non-QM Salary & Self-employed borrower Asset Program – True Stated Income – AAA Lendings Detail:

Overview

Use Borrower’s 6 months deposits of monthly income to support the stated income in 1003.

Program Highlights

1) No P&L Needed;

2) No WVOE Needed;

3) 12 months reserves calculated on PI;

4) Gift funds allowed;

5) Loan amount up to $2.5M;

6) Purchase & No R/T.

What is True Stated Income?

• Do you know how to use asset only to qualify for you house mortgage loan?

• Were you suspended or denied by the lender for a WVOE (Written Verification of Employment) program?

• Does your assets have not so much when you want to buy your own house?

• Didn’t your employer want to provide a WVOE form or cooperate?

If you have ever met the above situations, the program is similar with the {WVOE} program, it’s designed for salaried borrowers and self-employed borrowers. Non-QM loans have little such good programs that wage earners and business owners can both apply for.

How does this program work?

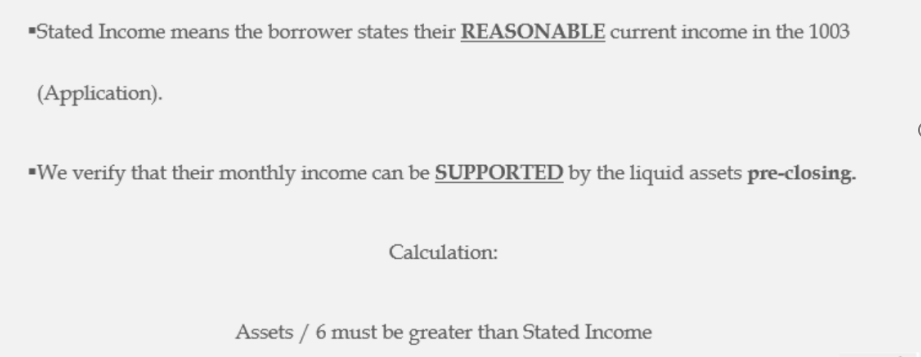

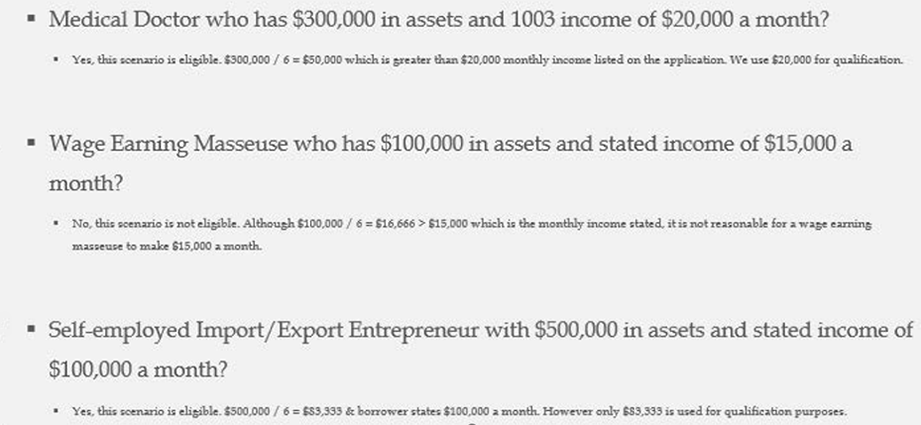

Just like the product name, this program is qualified with asset as well. See below:

If to choose the True Stated Income program, the borrower will only be required to provide an Asset Based Income on the Loan Application (1003). This income will be utilized to calculate qualifying debt to income ratio.

Who can apply for this program?

No matter you are a salary borrower or a self-employed borrower, you can apply for this program. For salary borrowers, no special documents are needed when you apply a new house mortgage loan of Non-QM with the lender. For self-employed borrowers or 1099 borrowers, a CPA letter may required.

Product detail pictures:

Related Product Guide:

While many lenders have limited their scope, we continue to expand our presence across various states, serving borrowers in 45 states, including some of the most dynamic markets like California and Texas. Our expansive reach allows us to understand and adapt to regional nuances, ensuring that our clients in different states receive localized support while still benefiting from our nationwide expertise. – AAA Lendings Non-QM Salary & Self-employed borrower Asset Program – True Stated Income – AAA Lendings , The product will supply to all over the world, such as: Brasilia , Brasilia , Anguilla , By integrating manufacturing with foreign trade sectors, we can provide total customer solutions by guaranteeing the delivery of right products to the right place at the right time, which is supported by our abundant experiences, powerful production capability, consistent quality, diversified products and the control of the industry trend as well as our maturity before and after sales services. We'd like to share our ideas with you and welcome your comments and questions.

The company keeps to the operation concept scientific management, high quality and efficiency primacy, customer supreme, we have always maintained business cooperation. Work with you,we feel easy!