– AAA Lendings Non-QM Salary & Self-employed borrower Asset Program – True Stated Income – AAA Lendings Detail:

Overview

Use Borrower’s 6 months deposits of monthly income to support the stated income in 1003.

Program Highlights

1) No P&L Needed;

2) No WVOE Needed;

3) 12 months reserves calculated on PI;

4) Gift funds allowed;

5) Loan amount up to $2.5M;

6) Purchase & No R/T.

What is True Stated Income?

• Do you know how to use asset only to qualify for you house mortgage loan?

• Were you suspended or denied by the lender for a WVOE (Written Verification of Employment) program?

• Does your assets have not so much when you want to buy your own house?

• Didn’t your employer want to provide a WVOE form or cooperate?

If you have ever met the above situations, the program is similar with the {WVOE} program, it’s designed for salaried borrowers and self-employed borrowers. Non-QM loans have little such good programs that wage earners and business owners can both apply for.

How does this program work?

Just like the product name, this program is qualified with asset as well. See below:

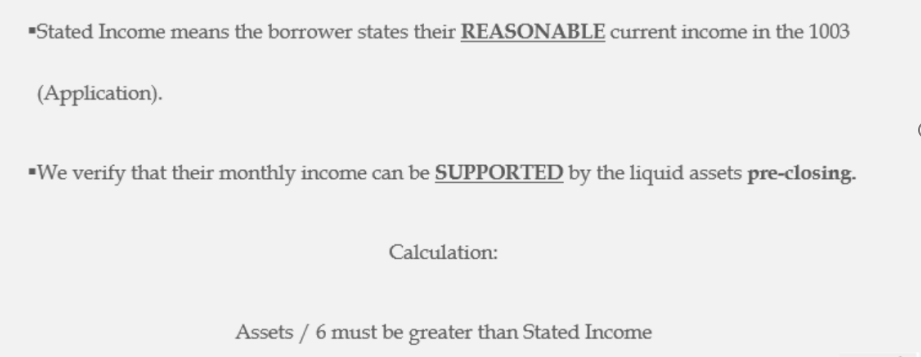

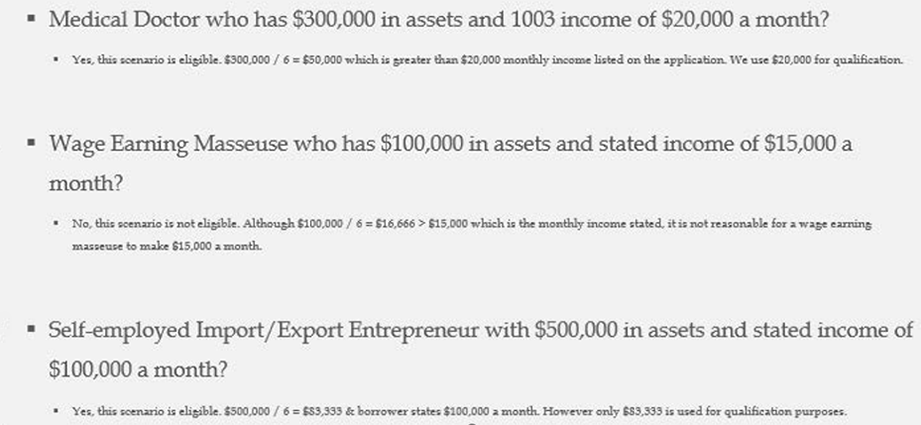

If to choose the True Stated Income program, the borrower will only be required to provide an Asset Based Income on the Loan Application (1003). This income will be utilized to calculate qualifying debt to income ratio.

Who can apply for this program?

No matter you are a salary borrower or a self-employed borrower, you can apply for this program. For salary borrowers, no special documents are needed when you apply a new house mortgage loan of Non-QM with the lender. For self-employed borrowers or 1099 borrowers, a CPA letter may required.

Product detail pictures:

Related Product Guide:

At AAA LENDINGS, we believe in giving back to our valued customers. That's why we offer a loyalty program that rewards you for your trust and ongoing partnership with us. Our loyalty program is designed to keep you engaged and appreciated, offering exclusive benefits and discounts for our returning customers. Your commitment to AAA LENDINGS is recognized and rewarded, and we strive to make your continued interest in our services a rewarding experience. – AAA Lendings Non-QM Salary & Self-employed borrower Asset Program – True Stated Income – AAA Lendings , The product will supply to all over the world, such as: Adelaide , Sri Lanka , Slovakia , By integrating manufacturing with foreign trade sectors, we can present total customer solutions by guaranteeing the delivery of right merchandise to the right place at the right time, which is supported by our abundant experiences, powerful production capability, consistent quality, diversified products and the control of the industry trend as well as our maturity before and after sales services. We'd like to share our ideas with you and welcome your comments and questions.

In China, we have many partners, this company is the most satisfying to us, reliable quality and good credit, it is worth appreciation.