– AAA Lendings Non-QM Salary & Self-employed borrower Asset Program – True Stated Income – AAA Lendings Detail:

Overview

Use Borrower’s 6 months deposits of monthly income to support the stated income in 1003.

Program Highlights

1) No P&L Needed;

2) No WVOE Needed;

3) 12 months reserves calculated on PI;

4) Gift funds allowed;

5) Loan amount up to $2.5M;

6) Purchase & No R/T.

What is True Stated Income?

• Do you know how to use asset only to qualify for you house mortgage loan?

• Were you suspended or denied by the lender for a WVOE (Written Verification of Employment) program?

• Does your assets have not so much when you want to buy your own house?

• Didn’t your employer want to provide a WVOE form or cooperate?

If you have ever met the above situations, the program is similar with the {WVOE} program, it’s designed for salaried borrowers and self-employed borrowers. Non-QM loans have little such good programs that wage earners and business owners can both apply for.

How does this program work?

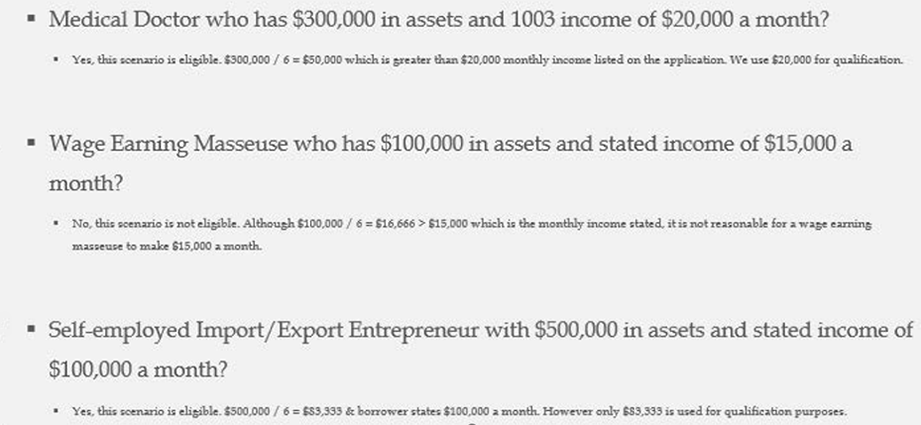

Just like the product name, this program is qualified with asset as well. See below:

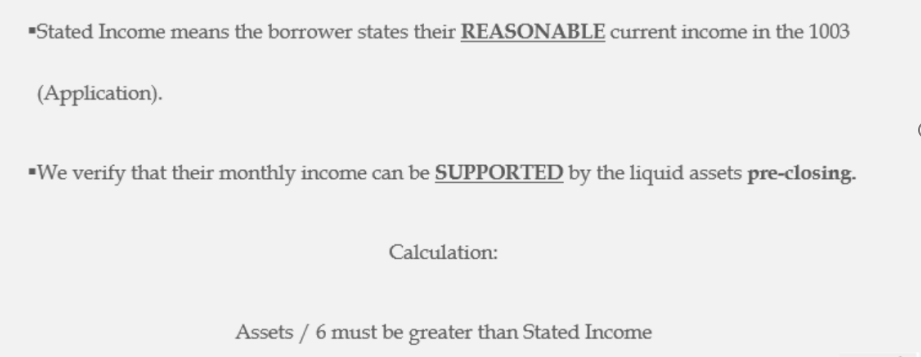

If to choose the True Stated Income program, the borrower will only be required to provide an Asset Based Income on the Loan Application (1003). This income will be utilized to calculate qualifying debt to income ratio.

Who can apply for this program?

No matter you are a salary borrower or a self-employed borrower, you can apply for this program. For salary borrowers, no special documents are needed when you apply a new house mortgage loan of Non-QM with the lender. For self-employed borrowers or 1099 borrowers, a CPA letter may required.

Product detail pictures:

Related Product Guide:

Planning your financial future begins with the right mortgage partner, and at AAA LENDINGS, we are committed to helping you achieve your dreams. We understand that the journey towards homeownership can be exciting but also daunting. Our seasoned professionals are more than just mortgage experts; they are your financial allies. They are available to discuss your goals, assess your financial situation, and provide personalized guidance that captures your interest. We take pride in being the guiding hand that empowers you to make informed decisions about your future. – AAA Lendings Non-QM Salary & Self-employed borrower Asset Program – True Stated Income – AAA Lendings , The product will supply to all over the world, such as: Washington , Somalia , Spain , We've customers from more than 20 countries and our reputation has been recognized by our esteemed customers. Never-ending improvement and striving for 0% deficiency are our two main quality policies. Ought to you want anything, don't hesitate to contact us.

We are really happy to find such a manufacturer that ensuring product quality at the same time the price is very cheap.