– AAA Lendings Non-QM DSCR(Debt Service Coverage Ratio) Program – AAA Lendings Detail:

Overview

Most simple product in the varieties of Non-QM programs.

No Income/ No Employment/ No Tax Returns, neither comparing DTI ratio like conventional loans. Only if the subject property is an investment property.

Details

1) Up to $2M loan amounts;

2) Up to 80% Max LTV;

3) 660 or greater credit scores;

4) Can close in entities;

5) No limits on number of properties financed;

6) SFRs, 2-4 Units, Condos, Townhomes, Condotels, and Non-Warrantable Condos.

DSCR Program

DSCR (Debt Service Coverage Ratio) is designed for experienced real estate investors and qualifies borrowers based on cash-flows solely from the subject property to analyze the risk degree of an investment. Today, we focus on understanding the definition of DSCR and unveiling the mystery of DSCR program from the perspective of housing mortgage investment. Next, let’s walk into the DSCR program.

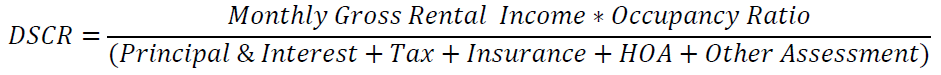

How to calculate DSCR?

For housing mortgage loans, DSCR refers to the ratio of monthly rental income of an investment house to total housing expenses(such as principal, interest, land tax, insurance and management fee (if some expenses are not actually incurred, it will be recorded as 0)). The lower the ratio, the greater the risk of the loan. It can be expressed in the following:

We AAA Lendings now offers “No ratio DSCR” for our clients, which means the ratio can be down to “0″. In our convention loan products, we need to compare our income with the monthly PITIA(Principle/ Interest/ Tax/ Insurance/ HOA) and other liabilities of the mortgaged house to decide if the loan can qualify.

What is DSCR?

Do you know how to qualify a house mortgage loan without any job information and income?

Are you not qualified with the conventional mortgage loans?

Do you know which loan program is the easiest product?

Do you want to know how to use the reduced documents to qualify a loan?

Is it very difficult for you to get a home loan in your industry?

We offer a perfect loan program to satisfy the above key factors, that’s DSCR program, which is the most popular Non-QM product in house mortgage loans.

DSCR (Debt Service Coverage Ratio) is designed for experienced real estate investors and qualifies borrowers based on cash-flows solely from the subject property to analyze the risk degree of an investment. Today, we focus on understanding the definition of DSCR and unveiling the mystery of DSCR program from the perspective of housing mortgage investment. Next, let’s walk into the DSCR program.

What’s the benefits of DSCR program?

No ratio DSCR, a loan product that does not check the income, has no requirements for the income of guests, because this loan product does not involve the calculation of DTI. And the minimum DSCR ratio can be as low as 0. Even if the rent of the house is low, we can still do it! This is a good choice for guests with low income or more liabilities.

Besides, Foreign Nationals are acceptable for this program as well, especially with F1 visa. If you’re a foreigner, and can not qualify with a conventional mortgage loan, contact us and obtain your loan scenario.

Our guidelines are flexible and if your loan makes sense we will help you close it quickly. We have smooth communication and fast proceeds for Non-QM loans, contact us if you have any needs.

You make more money! Our average submission to close is less than 3 weeks and we close without hassles. Imagine how your referrals will increase.

Product detail pictures:

Related Product Guide:

We understand that a mortgage is not just a financial transaction but a significant life decision. Our focus on customer-centricity means that we don't just consider the numbers; we consider your unique story, aspirations, and financial goals. Our mortgage experts take the time to understand your personal journey, ensuring that you receive a mortgage solution that aligns with your vision for the future. – AAA Lendings Non-QM DSCR(Debt Service Coverage Ratio) Program – AAA Lendings , The product will supply to all over the world, such as: Poland , Argentina , Russia , We confirm to public, cooperation, win-win situation as our principle, adhere to the philosophy of make a living by quality, keep developing by honesty , sincerely hope to build up a good relationship with more and more customers and friends, to achieve a win-win situation and common prosperity.

The enterprise has a strong capital and competitive power, product is sufficient, reliable, so we have no worries on cooperating with them.