– AAA Lendings Non-QM DSCR (Debt Service Coverage Ratio) Program – AAA Lendings Detail:

Overview

DSCR (Debt Service Coverage Ratio) Program.

This is the easiest program among all of the Non-QM programs.

Income/ Employment Status/ Tax Return is not required.

Program Highlights

1) Up to $2M Loan Amount;

2) Up to 75% LTV;

3) 660 or higher Credit Score;

4) May close in entities;

5) No limits on number of properties financed;

6) SFRs, 2-4 Units, Condos, Townhomes, Condotels, and Non-Warrantable Condos are available.

What is DSCR?

Do you know how to qualify a house mortgage loan without any job information and income?

Are you not qualified with the conventional mortgage loans?

Do you know which loan program is the easiest product?

Do you want to know how to use the reduced documents to qualify a loan?

Is it very difficult for you to get a home loan in your industry?

We offer a perfect loan program to satisfy the above key factors – DSCR program. It is the most popular Non-QM product in house mortgage loans.

DSCR (Debt Service Coverage Ratio) is designed for experienced real estate investors and qualifies borrowers based on cash-flows solely from the subject property to analyze the risk degree of an investment. Today, we focus on understanding the definition of DSCR and unveiling the mystery of DSCR program from the perspective of housing mortgage investment.

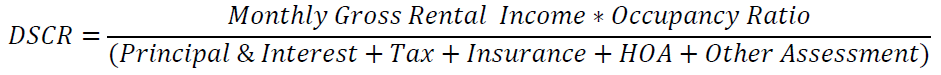

How to calculate DSCR?

For housing mortgage loans, DSCR refers to the ratio of monthly rental income of an investment house to total housing expenses(such as principal, interest, land tax, insurance and management fee (if some expenses are not actually incurred, it will be recorded as 0)). The lower the ratio, the greater the risk of the loan. It can be expressed in the following:

We offer “No ratio DSCR” for our clients, which means the ratio can be down to “0″. In our conventional loan products, we need to compare our income with the monthly PITIA(Principle/ Interest/ Tax/ Insurance/ HOA) and other liabilities of the mortgaged house to decide if the loan can qualify.

Benefits of DSCR

No ratio DSCR, a loan product that does not verify the income, has no requirements for the income of borrower because it does not involve the calculation of DTI. And the minimum DSCR ratio can be as low as 0. Even if the rental income is low, we can still do it! This is a good choice for borrowers with low income or more liabilities.

Besides, Foreign Nationals are acceptable for this program as well, especially with F1 visa. If you’re a foreigner, and can not qualify with a conventional mortgage loan, contact us and obtain your loan scenario.

Product detail pictures:

Related Product Guide:

Navigating the mortgage landscape can be complicated, but AAA LENDINGS simplifies the process, making it engaging and stress-free. We offer a clear and concise document collection system, allowing you to easily upload the required paperwork online. We are keenly aware that your time is valuable, and by making the process smoother, we keep you actively engaged and in control of your mortgage journey. – AAA Lendings Non-QM DSCR (Debt Service Coverage Ratio) Program – AAA Lendings , The product will supply to all over the world, such as: New Orleans , Mauritius , Swedish , We rely on high-quality materials, perfect design, excellent customer service and the competitive price to win the trust of many customers at home and abroad. 95%products are exported to overseas markets.

Adhering to the business principle of mutual benefits, we have a happy and successful transaction, we think we will be the best business partner.