– AAA Lendings No n-QM DSCR (Debt Service Coverage Ratio) Program – AAA Lendings Detail:

Overview

The most simple product in the varieties of Non-QM programs.

No Income/No Employment/No Tax Returns.

Investment property ONLY.

Details

1) Up to $2M loan amounts;

2) Up to 80% LTV;

3) 660 or higher credit scores;

4) Can close in entities;

5) No limits on number of properties financed;

6) SFRs, 2-4 Units, Condos, Townhomes, Condotels, and Non-Warrantable Condos are available.

What is DSCR?

Do you know how to qualify a house mortgage loan without any job information and income?

Are you not qualified with the conventional mortgage loans?

Do you know which loan program is the easiest product?

Do you want to know how to use the reduced documents to qualify a loan?

Is it very difficult for you to get a home loan in your industry?

We offer a perfect loan program to satisfy the above key factors, that’s DSCR program, which is the most popular Non-QM product in house mortgage loans.

DSCR (Debt Service Coverage Ratio) is designed for experienced real estate investors and qualifies borrowers based on cash-flows solely from the subject property to analyze the risk degree of an investment. Today, we focus on understanding the definition of DSCR and unveiling the mystery of DSCR program from the perspective of housing mortgage investment. Next, let’s walk into the DSCR program.

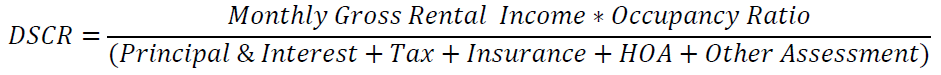

How to calculate DSCR?

For housing mortgage loans, DSCR refers to the ratio of monthly rental income of an investment house to total housing expenses(such as principal, interest, land tax, insurance and management fee (if some expenses are not actually incurred, it will be recorded as 0)). The lower the ratio, the greater the risk of the loan. It can be expressed in the following:

We offer “No ratio DSCR” for our clients, which means the ratio can be down to “0″. In our conventional loan products, we need to compare our income with the monthly PITIA(Principle/ Interest/ Tax/ Insurance/ HOA) and other liabilities of the mortgaged house to decide if the loan can qualify.

Benefits of DSCR

No ratio DSCR, a loan product that does not verify the income, has no requirements for the income of borrower, because this loan product does not involve the calculation of DTI. And the minimum DSCR ratio can be as low as 0. Even if the rent of the house is low, we can still do it! This is a good choice for borrower with low income or more liabilities.

Besides, Foreign Nationals are acceptable for this program as well, especially with F1 visa. If you’re a foreigner, and can not qualify with a conventional mortgage loan, contact us and obtain your loan scenario.

Our guidelines are flexible and if your loan makes sense, we will help you close it quickly. We have smooth communication and fast proceeds for Non-QM loans, contact us if you have any needs.

Product detail pictures:

Related Product Guide:

Customer education is a cornerstone of AAA LENDINGS' mission. We believe that an informed borrower is an empowered borrower. That's why we go the extra mile to provide educational resources and guidance to help you navigate the complexities of the mortgage process. Our team is dedicated to answering your questions, explaining the intricacies of interest rates, loan options, and more, ensuring that you make well-informed decisions. Your financial literacy and confidence matter to us. – AAA Lendings No n-QM DSCR (Debt Service Coverage Ratio) Program – AAA Lendings , The product will supply to all over the world, such as: Ottawa , Ethiopia , Johor , We believe with our consistently excellent service you can get the best performance and cost least goods from us for a long term . We commit to provide better services and create more value to all our customers. Hope we can create a better future together.

The factory can meet continuously developing economic and market needs, so that their products are widely recognized and trusted, and that's why we chose this company.