– AAA Lendings Enhanced R series – Elite True Stated Income – AAA Lendings Detail:

Overview

Similar with True Stated Income.

CA, CO, GA, IL, TX, VA, WA are available.

Program Highlights

7/6 ARM (5/1/5)

1) No P&L Needed;

2) No WVOE Needed;

3) No Tax Returns Needed;

4) No 4506-T Needed;

5) Gift funds allowed;

6) Loan amount up to $2.0M;

7) Purchase & R/T Refinance are available.

What is Elite True Stated Income?

• Do you know how to use enough assets only to qualify for you house mortgage loan?

• Were you suspended or denied by the lender for a WVOE (Written Verification of Employment) program?

• Do you have not enough assets when you want to buy your own house?

• Didn’t your employer want to provide a WVOE form or cooperate?

The program is similar with the {True Stated Income} program, it’s designed for salaried borrowers and self-employed borrowers.

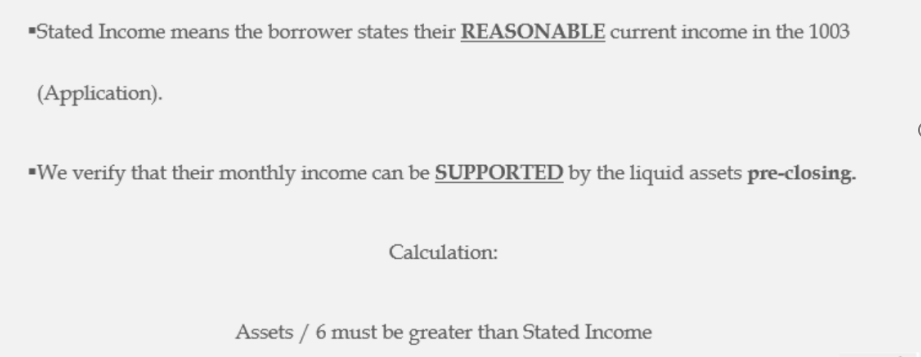

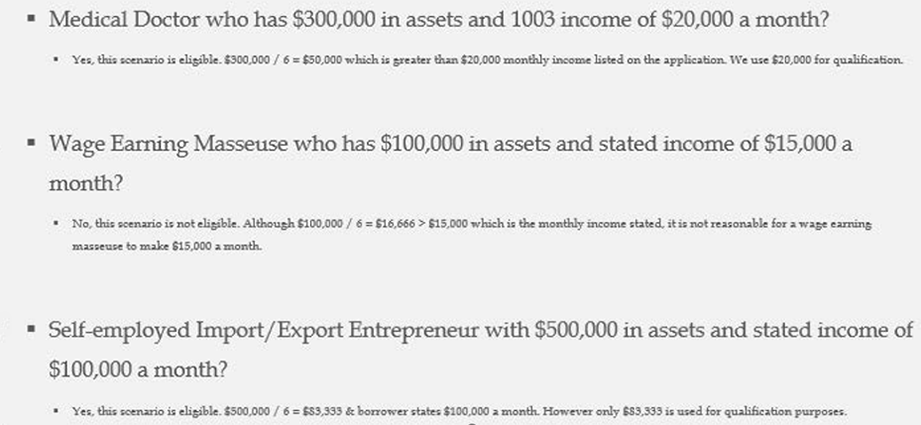

How does Elite True Stated Income work?

Just like what the product name, this program is qualified with asset as well. See below:

If we choose the Elite True Stated Income, the borrower will only be required to provide an Asset Based Income on the Loan Application (1003). This income will be utilized to calculate qualifying debt to income ratio.

Who can apply for Elite True Stated Income?

As mentioned the above, whatever you are salary borrower or self-employed borrower, you can apply for Elite True Stated Income. For salary borrower, special documents are not needed when you apply a new house mortgage loan with a Non-QM lender. For self-employed borrowers or 1099 borrowers, a CPA letter is required.

Product detail pictures:

Related Product Guide:

AAA LENDINGS is not just a lender; we are your financial partner. We take the time to listen to your financial goals and aspirations, offering guidance beyond the application process. Our commitment to your financial well-being extends far beyond closing the deal, and we are dedicated to helping you achieve your long-term objectives, whether that's homeownership, real estate investment, or debt consolidation. – AAA Lendings Enhanced R series – Elite True Stated Income – AAA Lendings , The product will supply to all over the world, such as: Hanover , Germany , Mexico , We are sincerely looking forward to cooperate with customers all over the world. We believe we can satisfy you with our high-quality products and perfect service . We also warmly welcome customers to visit our company and purchase our products.

Product variety is complete, good quality and inexpensive, the delivery is fast and transport is security, very good, we are happy to cooperate with a reputable company!