– AAA Lendings Enhanced R series – Elite True Stated Income – AAA Lendings Detail:

Overview

Similar with True Stated Income.

CA, CO, GA, IL, VA, WA are available.

Program Highlights

7/6 ARM (5/1/5)

1) No P&L Needed;

2) No WVOE Needed;

3) No Tax Returns Needed;

4) No 4506-T Needed;

5) Gift funds allowed;

6) Loan amount up to $2.0M;

7) Purchase & R/T Refinance are available.

What is Elite True Stated Income?

• Do you know how to use enough assets only to qualify for you house mortgage loan?

• Were you suspended or denied by the lender for a WVOE (Written Verification of Employment) program?

• Do you have not enough assets when you want to buy your own house?

• Didn’t your employer want to provide a WVOE form or cooperate?

The program is similar with the {True Stated Income} program, it’s designed for salaried borrowers and self-employed borrowers.

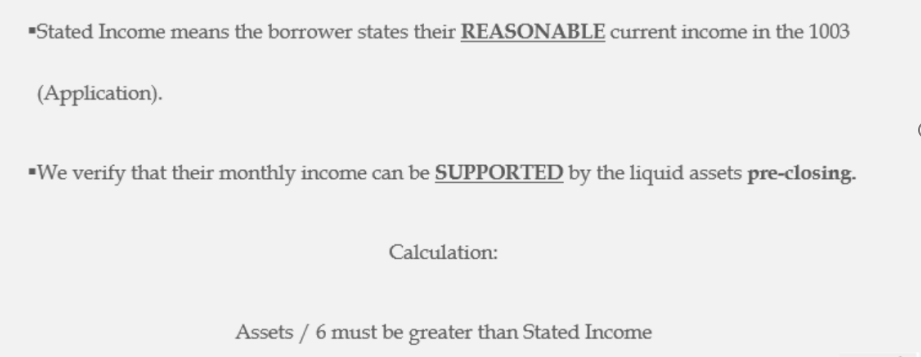

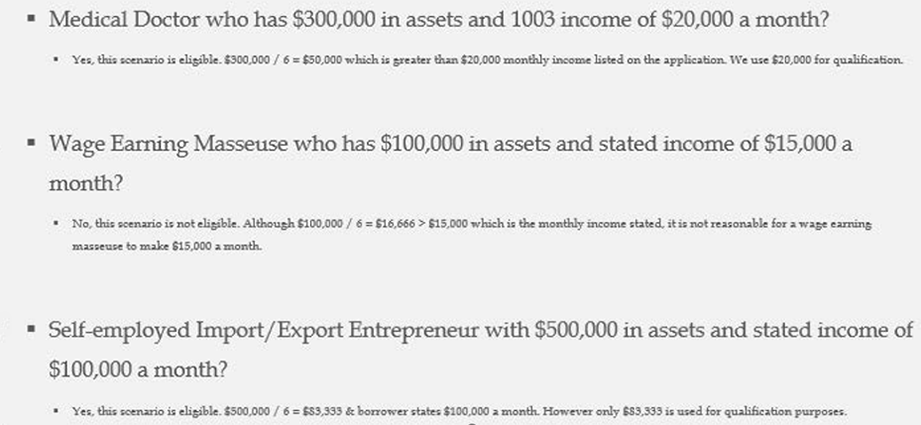

How does Elite True Stated Income work?

Just like what the product name, this program is qualified with asset as well. See below:

If we choose the Elite True Stated Income, the borrower will only be required to provide an Asset Based Income on the Loan Application (1003). This income will be utilized to calculate qualifying debt to income ratio.

Who can apply for Elite True Stated Income?

As mentioned the above, whatever you are salary borrower or self-employed borrower, you can apply for Elite True Stated Income. For salary borrower, special documents are not needed when you apply a new house mortgage loan with a Non-QM lender. For self-employed borrowers or 1099 borrowers, a CPA letter is required.

Product detail pictures:

Related Product Guide:

The dream of homeownership isn't limited to traditional homebuyers. At AAA LENDINGS, we have specialized programs to cater to non-traditional borrowers. If you're self-employed, have a fluctuating income, or face unique financial circumstances, our loan options can capture your interest. We embrace diversity in borrowers and actively seek out innovative lending solutions, ensuring that your journey to homeownership remains engaging, regardless of your financial situation. – AAA Lendings Enhanced R series – Elite True Stated Income – AAA Lendings , The product will supply to all over the world, such as: Morocco , Houston , Korea , We will not only continuously introduce technical guidance of experts from both home and abroad, but also develop the new and advanced products constantly to satisfactorily meet the needs of our clients all over the world.

The customer service staff's answer is very meticulous, the most important is that the product quality is very good, and packaged carefully, shipped quickly!