– AAA Lendings Enhanced R series – Elite True Stated Income – AAA Lendings Detail:

Overview

Similar with True Stated Income.

CA, CO, GA, IL, VA, WA are available.

Program Highlights

7/6 ARM (5/1/5)

1) No P&L Needed;

2) No WVOE Needed;

3) No Tax Returns Needed;

4) No 4506-T Needed;

5) Gift funds allowed;

6) Loan amount up to $2.0M;

7) Purchase & R/T Refinance are available.

What is Elite True Stated Income?

• Do you know how to use enough assets only to qualify for you house mortgage loan?

• Were you suspended or denied by the lender for a WVOE (Written Verification of Employment) program?

• Do you have not enough assets when you want to buy your own house?

• Didn’t your employer want to provide a WVOE form or cooperate?

The program is similar with the {True Stated Income} program, it’s designed for salaried borrowers and self-employed borrowers.

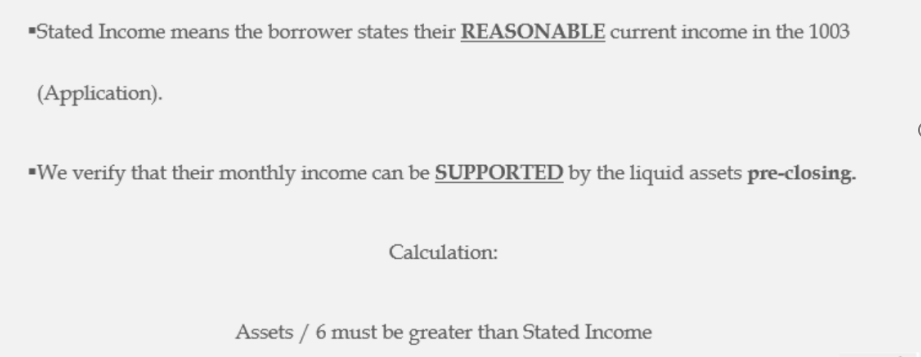

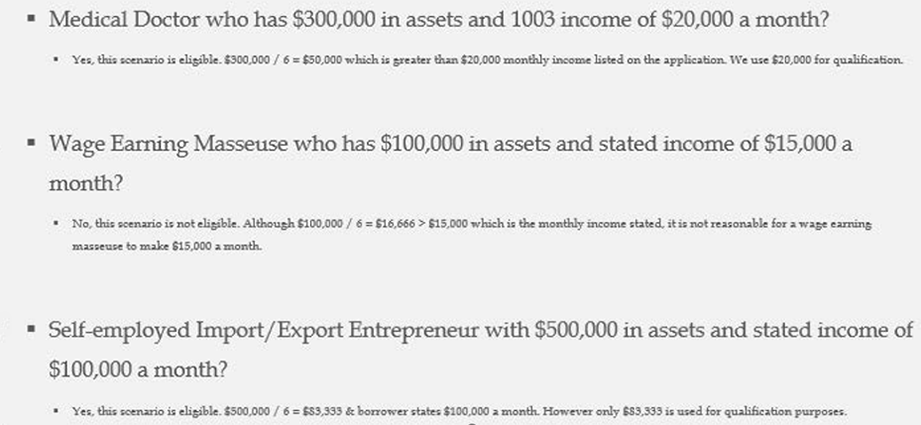

How does Elite True Stated Income work?

Just like what the product name, this program is qualified with asset as well. See below:

If we choose the Elite True Stated Income, the borrower will only be required to provide an Asset Based Income on the Loan Application (1003). This income will be utilized to calculate qualifying debt to income ratio.

Who can apply for Elite True Stated Income?

As mentioned the above, whatever you are salary borrower or self-employed borrower, you can apply for Elite True Stated Income. For salary borrower, special documents are not needed when you apply a new house mortgage loan with a Non-QM lender. For self-employed borrowers or 1099 borrowers, a CPA letter is required.

Product detail pictures:

Related Product Guide:

Planning your financial future begins with the right mortgage partner, and at AAA LENDINGS, we are committed to helping you achieve your dreams. We understand that the journey towards homeownership can be exciting but also daunting. Our seasoned professionals are more than just mortgage experts; they are your financial allies. They are available to discuss your goals, assess your financial situation, and provide personalized guidance that captures your interest. We take pride in being the guiding hand that empowers you to make informed decisions about your future. – AAA Lendings Enhanced R series – Elite True Stated Income – AAA Lendings , The product will supply to all over the world, such as: Luxembourg , Swaziland , moldova , Abiding by our motto of Hold well the quality and services, Customers Satisfaction, So we provide our clients with high quality products and excellent service. Please feel free to contact us for further information.

Staff is skilled, well-equipped, process is specification, products meet the requirements and delivery is guaranteed, a best partner!